---------------------------------------------------

# #

# Chapter 4: The ARCH Time Series Model #

# #

---------------------------------------------------

In the last chapter we simulated the model

S(t_k) = S(t_{k-1}) * [ 1 + vol(t_{k-1})*phi_k ] (1)

with

vol^2(t_{k-1}) = stddev_d^2(t_{k-1})

= 1/d * [ret^2(t_{k-1})+...+ret^2(t_{k-d})] (2)

and we saw, that the volatility in that model converged

to zero, the simulated paths stayed constant after a

while. Apparently vol(t_{k-1}) = 0 and S(t_k) = const

is a solution of the equations (1,2) for arbitrary

random numbers phi_k. On the other hand, we saw that the

model

S(t_k) = S(t_{k-1}) * [ 1 + bsvol * phi_k ] (3)

with a constant Black-Scholes volatility bsvol does not

have this problem, the simulated paths looked quite

reasonable. However, the data analysis of chapter 2

clearly revealed that volatility is not constant and

a good model should take this into account. Therefore,

as a compromise between the models (1,2) and (3), we

make the Ansatz:

vol^2(t_{k-1}) = w0*bsvol^2 + w1*stddev_d(t_{k-1})^2 (4)

= w0 * bsvol^2 +

w1 * 1/d * [ret^2(t_{k-1})+...+ret^2(t_{k-d})]

with some positive weights w0 and w1 with

w0 + w1 = 1 .

The price dynamics (1) with vol-specification (4) is

called the ARCH-model or more precisely the ARCH(d)-

model, since the history of the past d days is taken

into account.

Before we simulate a couple of paths, let's make some

remarks:

Remark 1) The letters A, R, C and H stand for

AR = AutoRegressive, that means, future returns depend

on past returns, and:

CH = Conditional Heteroskedastic, that means, that the current,

instantaneous volatilities are time dependent.

There are conditional or instantaneous variances or

volatilities,

vol^2(t_{k-1}) = E[ ret^2(t_k) | t_{k-1} ]

-- the notation on the right meaning that until time

t_{k-1} everything is known and the expectation is

taken only over phi_k -- and unconditional variances

or volatilities,

volbar^2 = E[ ret^2(t_k) ]

where the expectation is taken over all phi_k,...,phi_1.

Heteroskedastic simply means: not constant, but time

dependent.

Remark 2) Instead of vol-specification (4) one could

make the more general Ansatz

vol^2(t_{k-1}) = alpha0 +

alpha1 * ret^2(t_{k-1}) + ... + alphad * ret^2(t_{k-d}) (5)

with some d+1 parameters alpha0,...,alphad. Typically

the specification (5) can be found in the books as the

definition of the ARCH(d)-model. However, if one really

wants to fit the model to actual time series data, one

would merely choose a parametrization (4), eventually

not necessasarily with equally weighted returns, but

with linearly or exponentially weighted returns. The

GARCH-model discussed in chapter 7 is basically an

ARCH(d)-model with exponentially weighted returns.

In addition, the parameters w0 and bsvol in (4) have an

immediate intuitive meaning: as we will see in later

chapters when we estimate the parameters with the

maximum likelihood method, bsvol is usually very close

to the standard deviation of the realized returns

calculated over the full length of the time series.

Thus, we don't have to estimate this parameter

actually, but can calculate it directly as sd(ret),

the standard deviation of the return series.

Remark 3) In 2003, Robert Engle from New York Uni-

versity (together with Clive Granger) was awarded

the Nobel Prize in Economics "for methods of analy-

zing economic time series with time-varying vola-

tility (ARCH)".

Now let's start and simply take a look at some

simulated paths. To this end, we modify our

pathNaivArch-function from the last chapter:

#

# Start R-Session:

#

pathArchd = function( N , bsvol , w0 , d )

{

S = rep(0,N)

ret = rep(0,N)

phi = rnorm(N)

S0 = 100

vol0 = bsvol # we put startvol to bsvol

vol = rep(vol0,N) # ARCH-vol

sumretd = 0

# the first step, k=1, is special:

S[1] = S0*(1+vol0*phi[1])

ret[1] = (S[1]-S0)/S0

vol[1] = sqrt( w0*bsvol^2 + (1-w0)*ret[1]^2 )

sumretd = sumretd + ret[1]^2

for(k in 2:N)

{

if(k<=d)

{

S[k] = S[k-1]*(1+vol[k-1]*phi[k])

ret[k] = (S[k]-S[k-1])/S[k-1]

sumretd = sumretd + ret[k]^2

vol[k] = sqrt( w0*bsvol^2 + (1-w0)*sumretd/k )

}

else

{

S[k] = S[k-1]*(1+vol[k-1]*phi[k])

ret[k] = (S[k]-S[k-1])/S[k-1]

sumretd = sumretd + ret[k]^2

sumretd = sumretd - ret[k-d]^2

vol[k] = sqrt( w0*bsvol^2 + (1-w0)*abs(sumretd)/d )

}

}#next k

par(mfrow=c(2,1))

plot(S,type="l",ylim=c(0,250))

plot(ret,type="l",ylim=c(-0.08,0.08))

result = list(S,ret)

names(result) = c("S","ret")

return(result)

}

#

# let's check:

#

# this should be Black-Scholes:

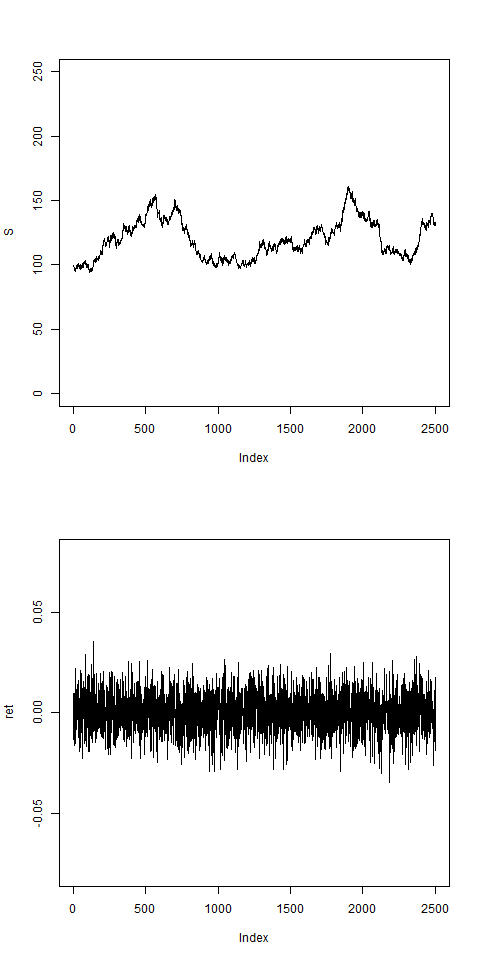

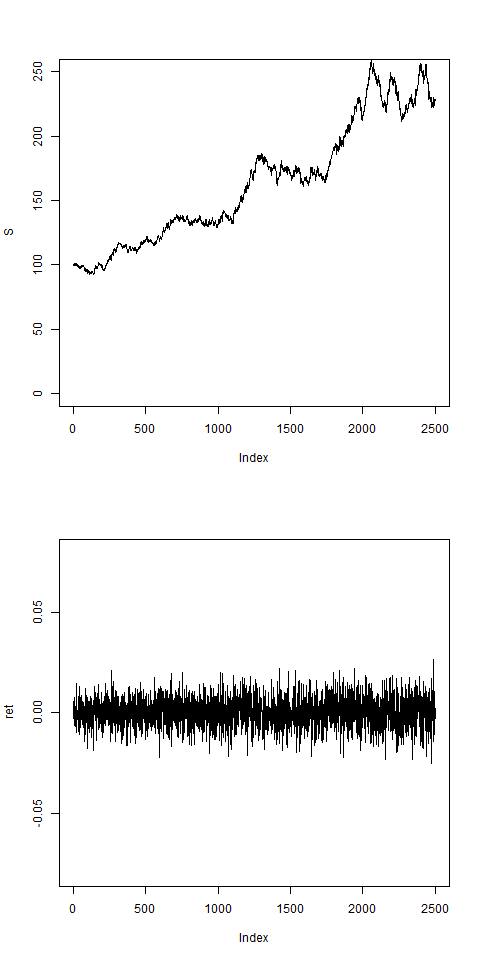

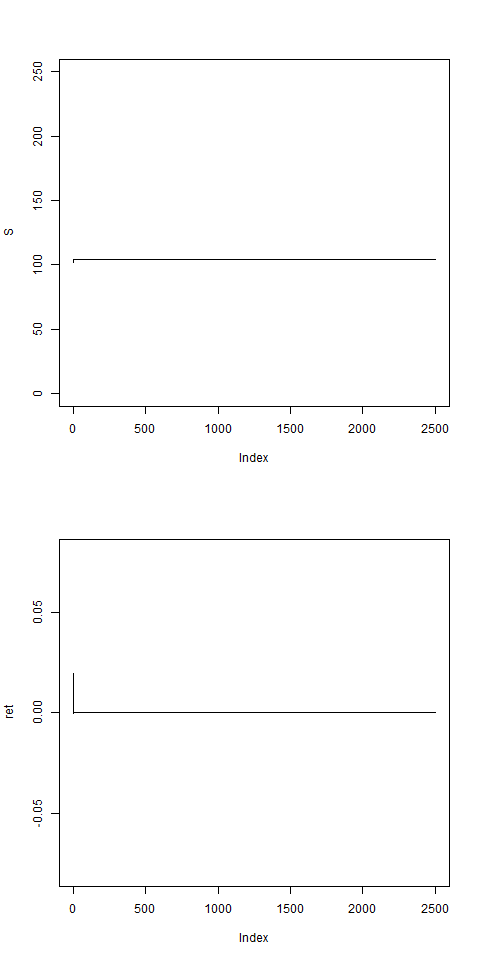

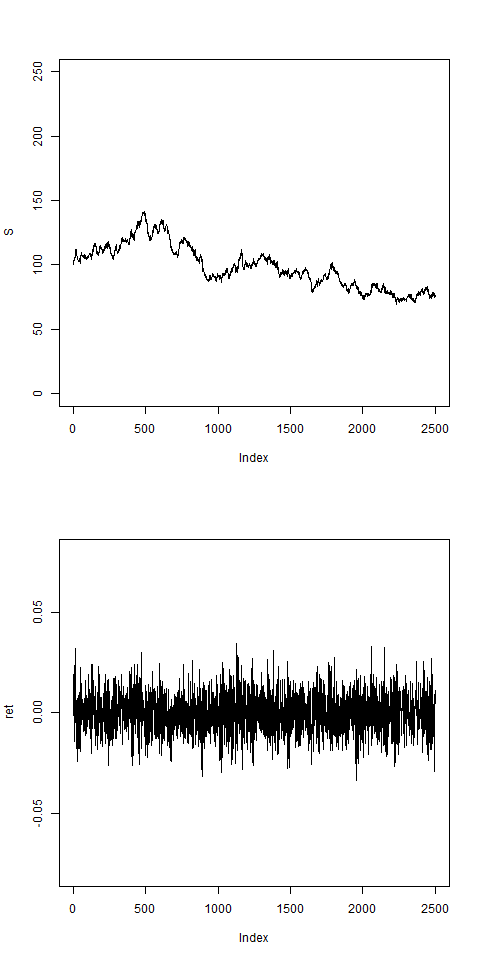

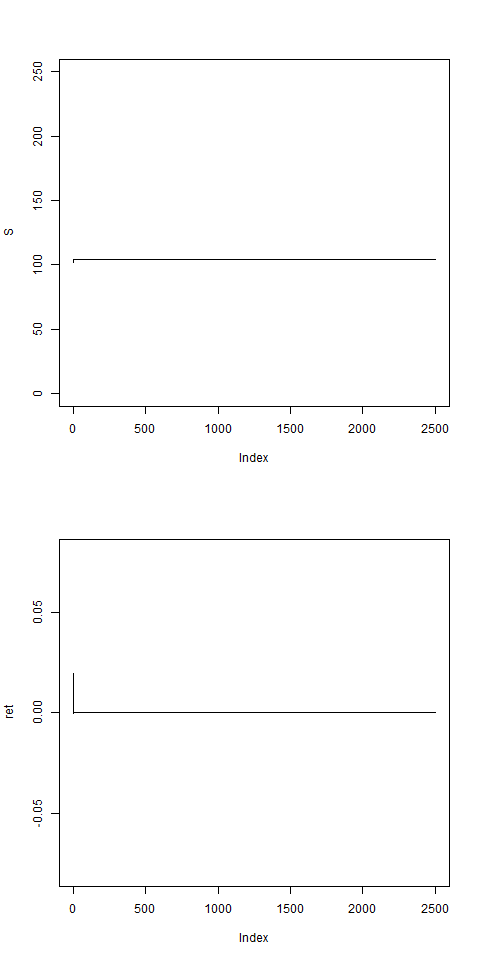

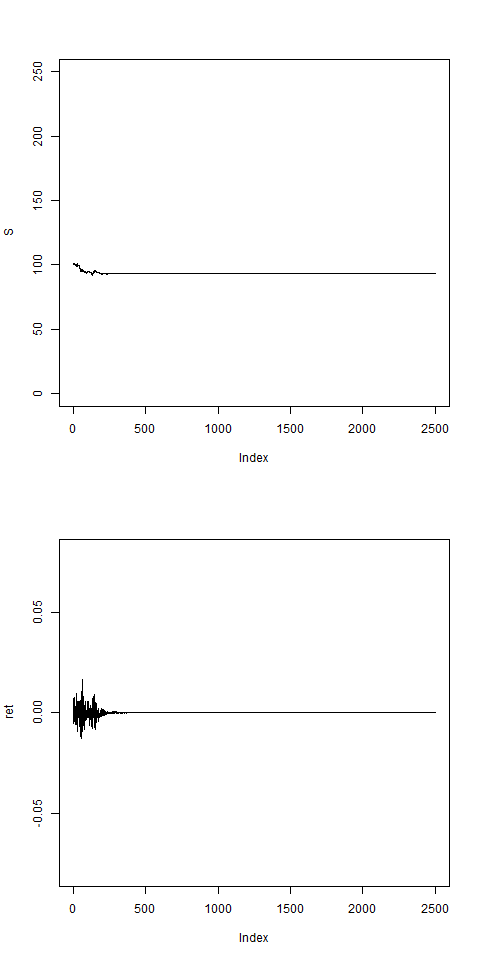

res = pathArchd( N=2500 , bsvol=0.01 , w0=1 , d=15 )

# returns are uniformly distributed:

# this is with variable vol:

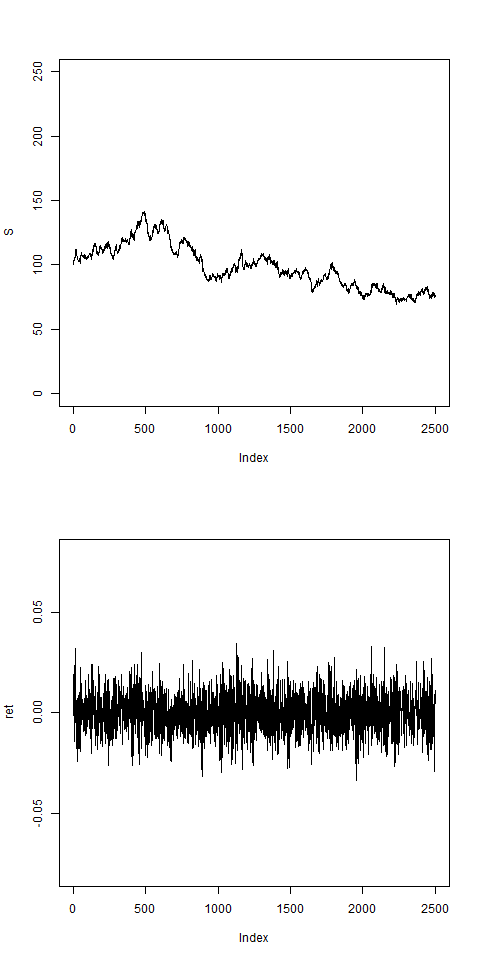

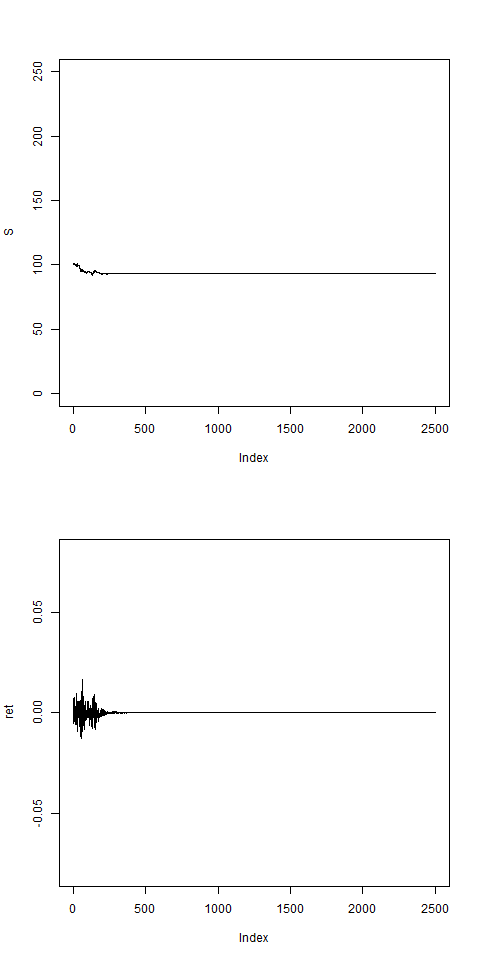

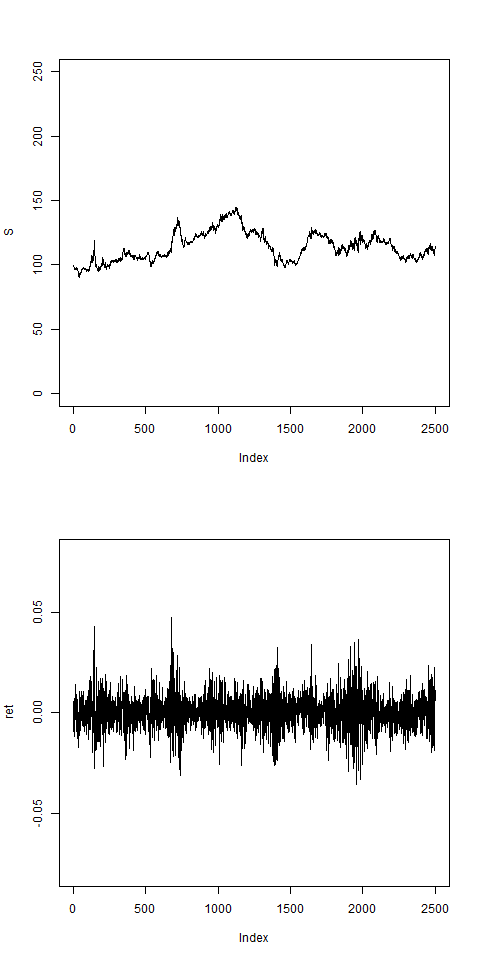

res = pathArchd( N=2500 , bsvol=0.01 , w0=0.5 , d=15 )

# vol looks still quite uniform:

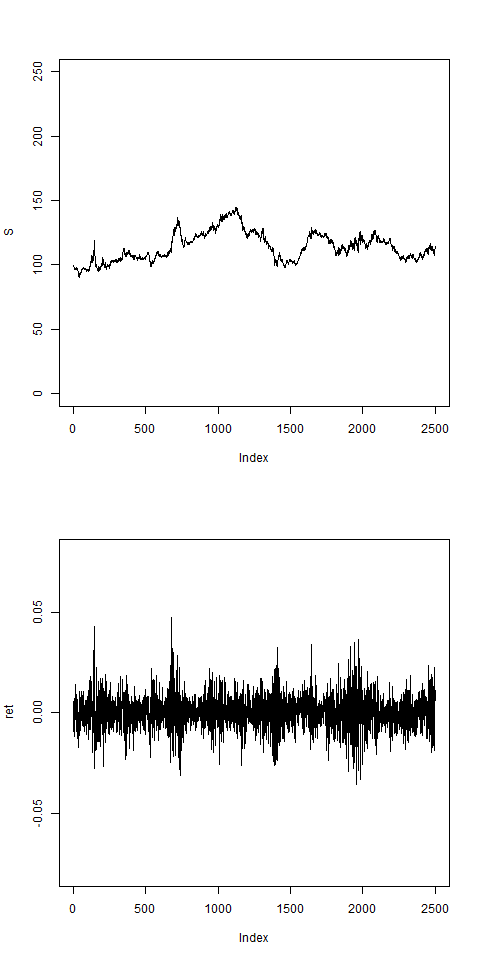

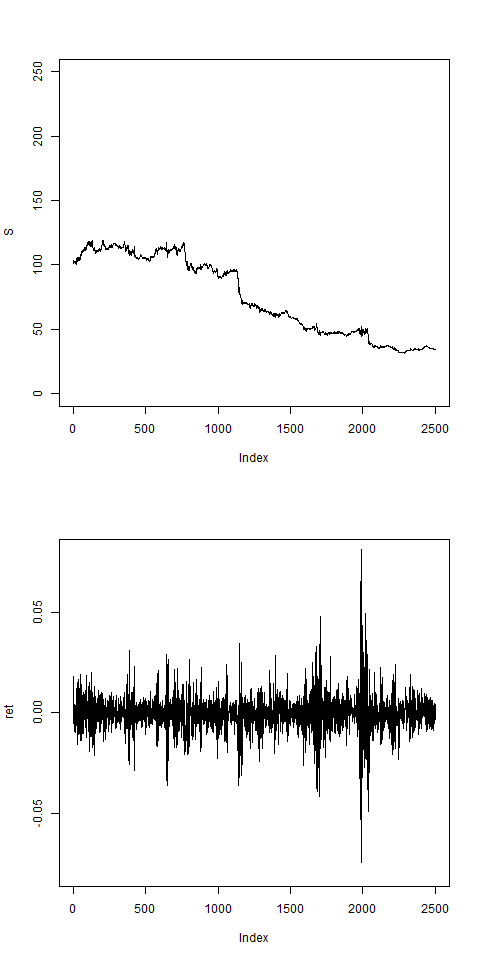

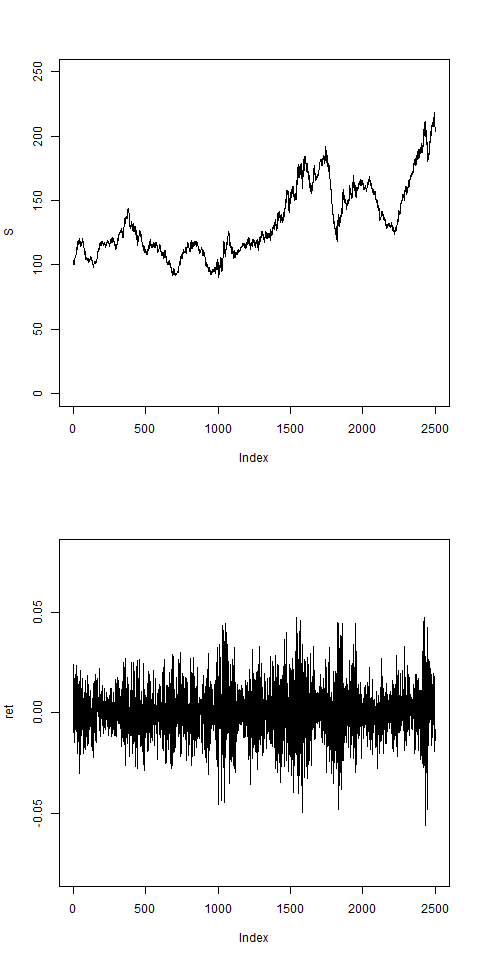

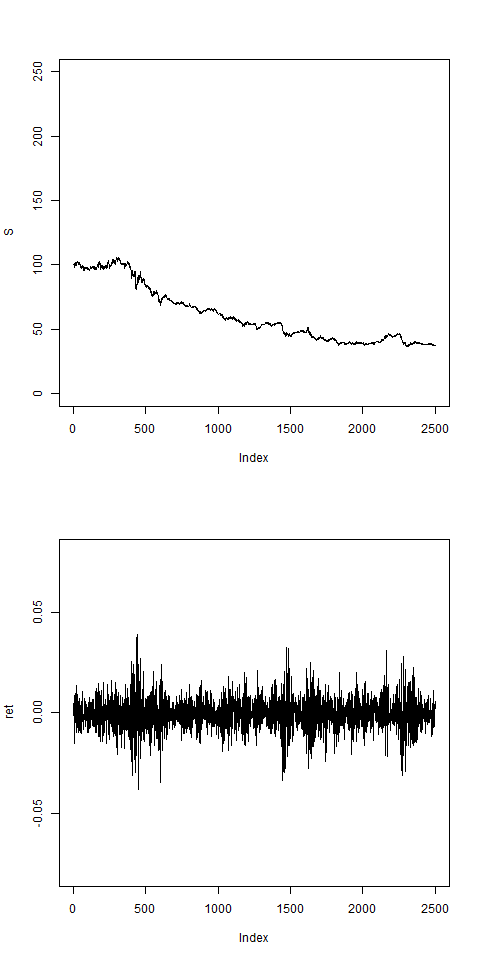

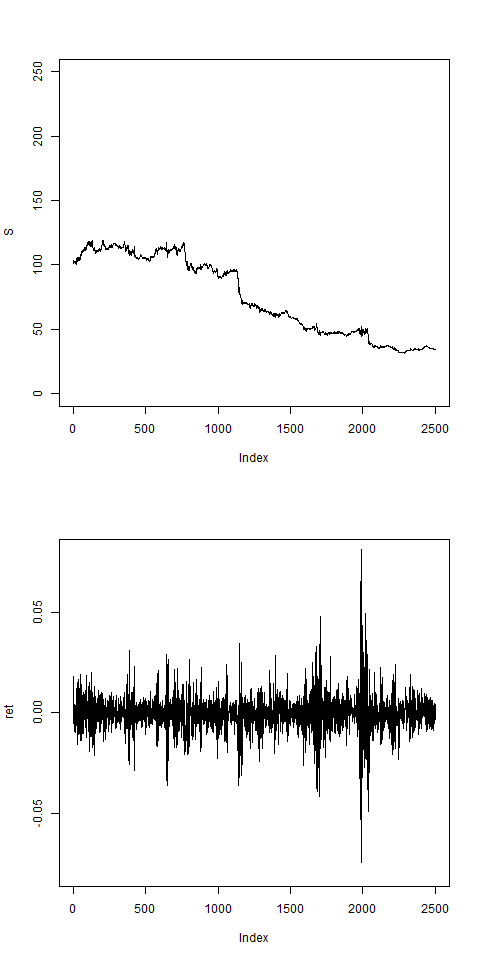

res = pathArchd( N=2500 , bsvol=0.01 , w0=0.1 , d=15 )

# this shows vol clustering:

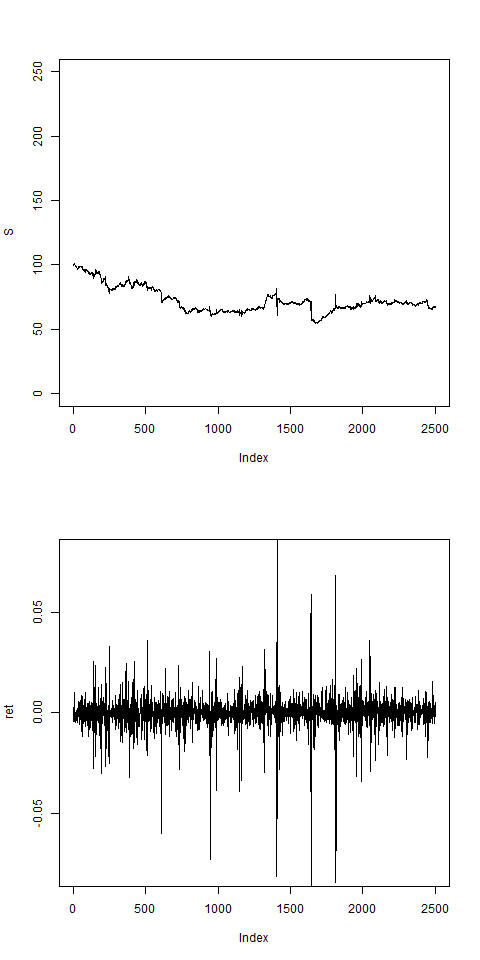

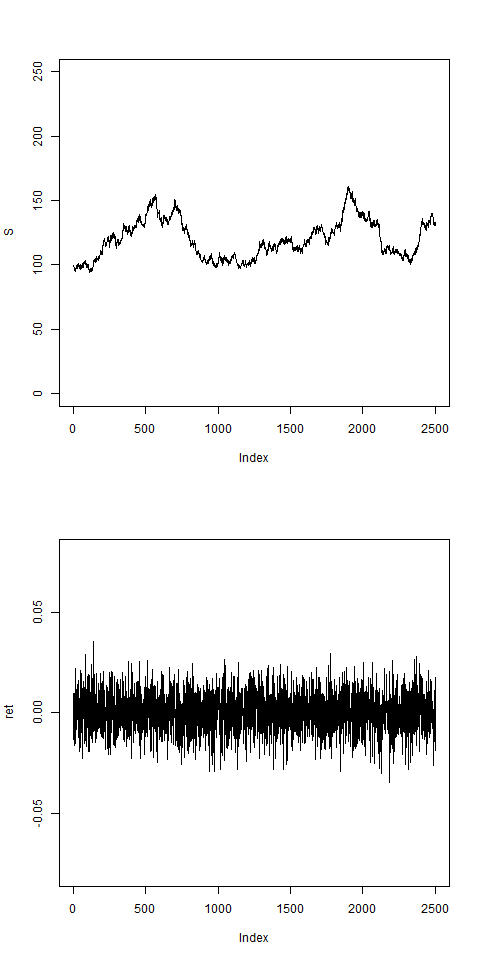

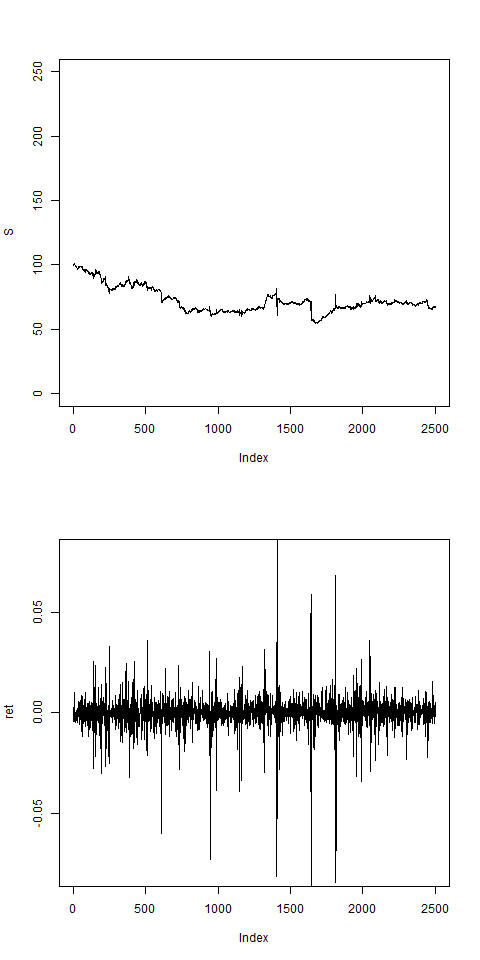

res = pathArchd( N=2500 , bsvol=0.01 , w0=0.1 , d=10 )

# this shows vol clustering:

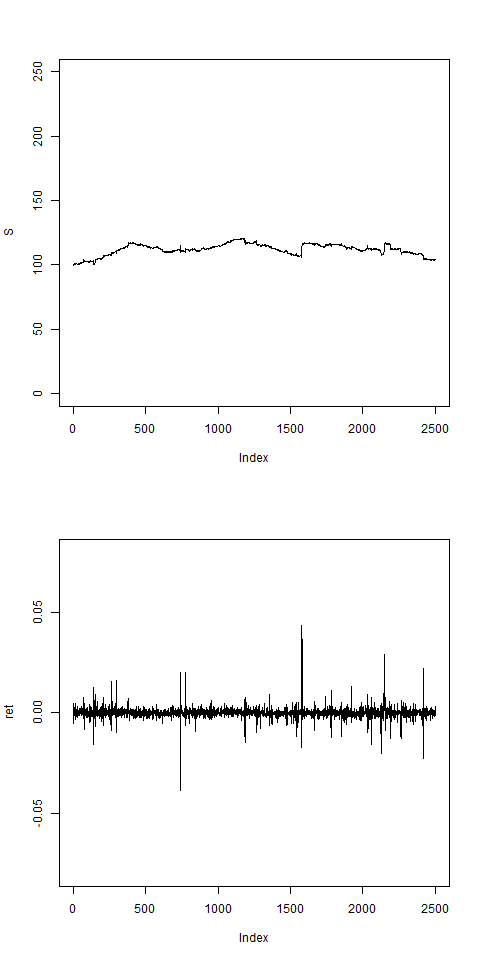

res = pathArchd( N=2500 , bsvol=0.01 , w0=0.1 , d=250 )

# for large d, returns become more uniform:

res = pathArchd( N=2500 , bsvol=0.01 , w0=0.1 , d=5 )

# this shows vol clustering:

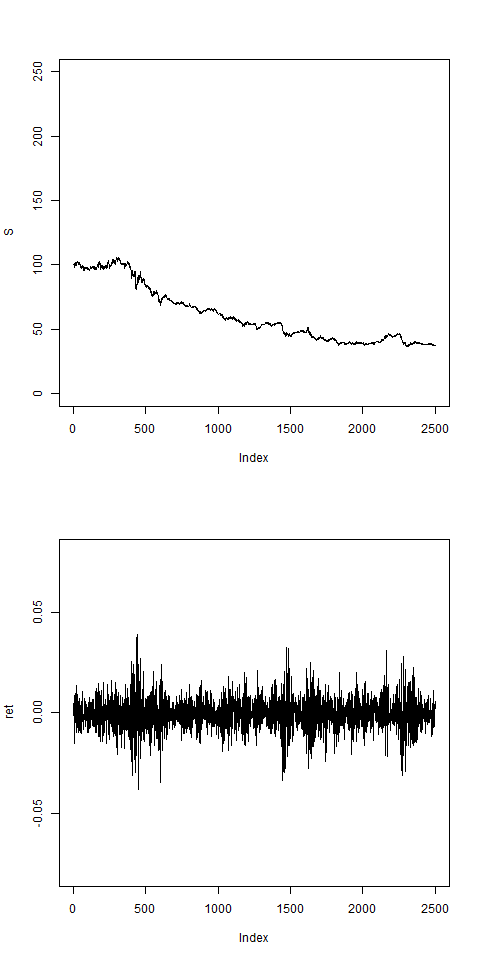

res = pathArchd( N=2500 , bsvol=0.01 ,w0=0.1 , d=1 )

res = pathArchd( N=2500 , bsvol=0.01 ,w0=0.01 , d=1 )

res = pathArchd( N=2500 , bsvol=0.01 ,w0=0 , d=1 )

# w0 > 0 necessary to stabilizes the model:

res = pathArchd( N=2500 , bsvol=0.01 ,w0=0 , d=15 )

# w0 > 0 necessary to stabilizes the model:

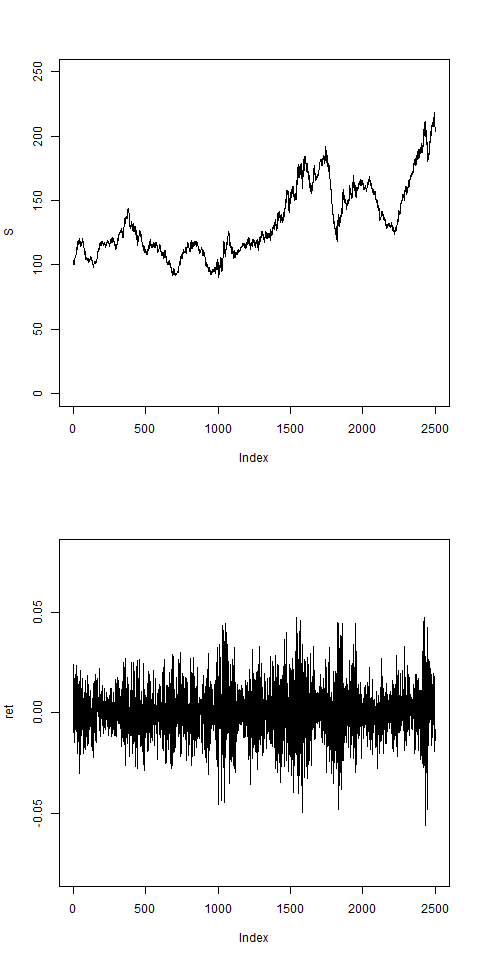

# a realistic set of parameters:

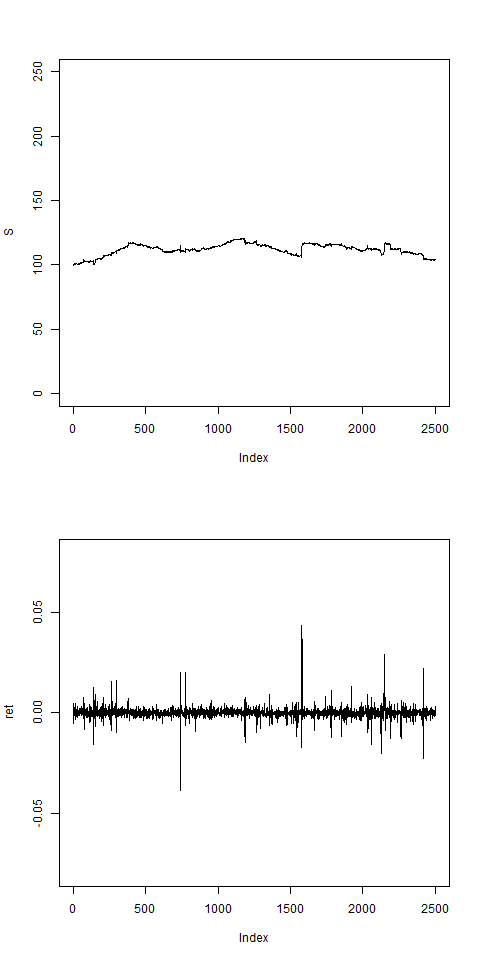

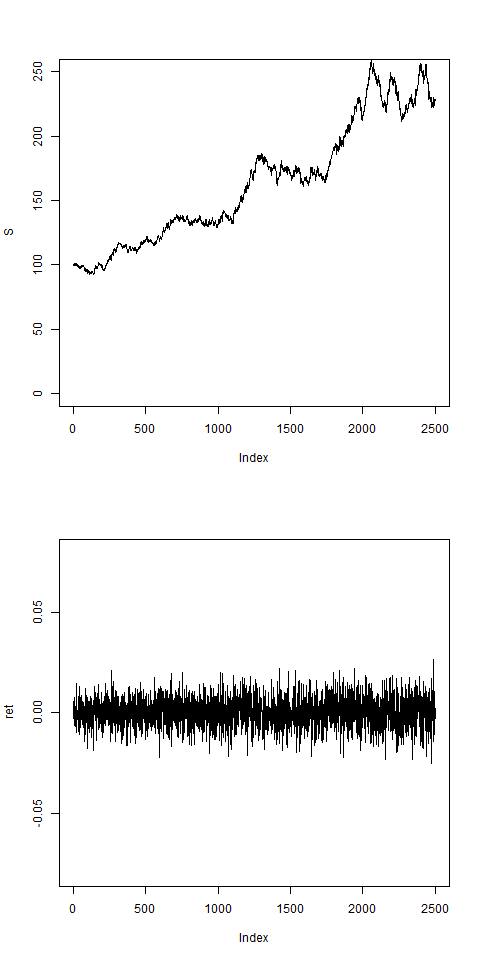

res = pathArchd( N=2500 , bsvol=0.015 ,w0=0.15, d=15 )

This looks not unreasonable. Now we can start to fit

the model to actual time series data. This we will do

in the next chapter with the maximum likelihood method.